Winston Pointe, Clayton NC (27520) Market Snapshot August 2018

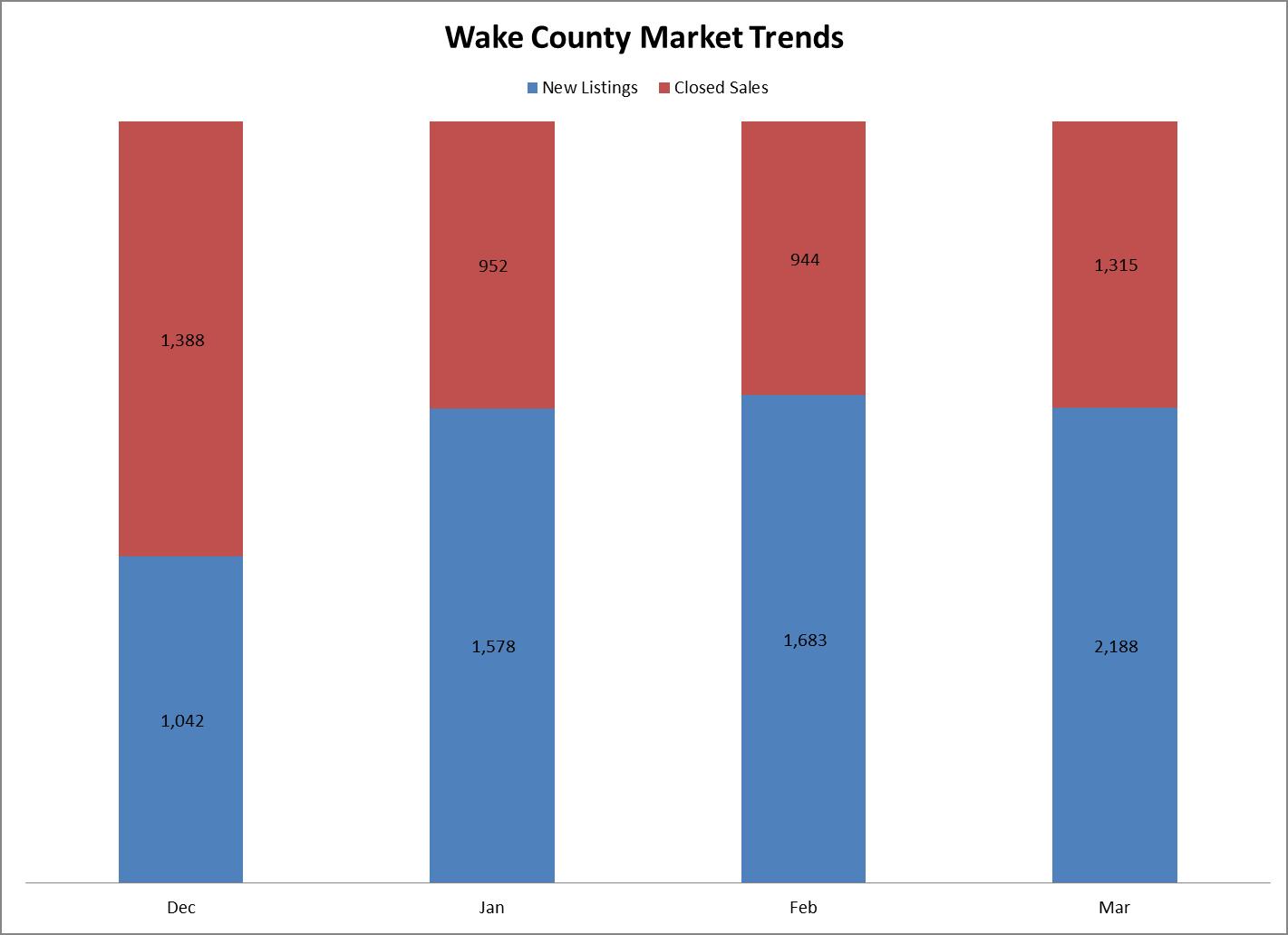

Winston Pointe in Clayton is another interesting neighborhood in Johnston County. Like Creekside in Garner, new construction is the primary market influence in yours. However, unlike in Creekside, your neighborhood is more established with homes dating to 2005 vintage thus …

Winston Pointe, Clayton NC (27520) Market Snapshot August 2018 Read more »